Government policy & the development of hybrid and electric vehicles in Japan

This fifth case study looks at the development of hybrid, electic and low emissions vehicles in Japan between the 1970s and the 1990s.

Japan’s dominance of the hybrid electric vehicle (HEV) market is the result of a conscious decision by the Japanese Government and automakers to invest in an area of strategic national interest, exploit an area of comparative advantage and commit to a programme of technology development spanning over 3 decades.

In the 1970s the Japanese Government, in response to the oil shocks and air pollution concerns, launched a series of market expansion plans for the development and commercialization of low emission vehicles (LEVs) and set targets for their uptake within Japan. The plans spanned horizons of at least 10 years and were intended to coordinate the actions of government agencies, automakers and suppliers, municipalities and universities in their effort to accelerate the development of LEVs. They identified the various barriers hindering technology development and called upon the various stakeholders to address those barriers through R&D, amending laws and regulations, creating new standards and building fuel infrastructure.

Over the course of two decades the MITI led a number of specific R&D initiatives, including the 5-year government-industry R&D programs launched in the 1970s, the electric vehicle field tests run through the late 1990s, specific research into new fuel cell and battery technologies as well as funding for high energy efficiency hybrid vehicles. The MITI funded programmes are usually long (>10 years) and divided into three phases starting with R&D on basic technologies, then demonstration and prototype, and finally, production and early deployment; the private sector is expected to increase its share of responsibility as the technology comes closer to commercialisation (Daito, 2002).

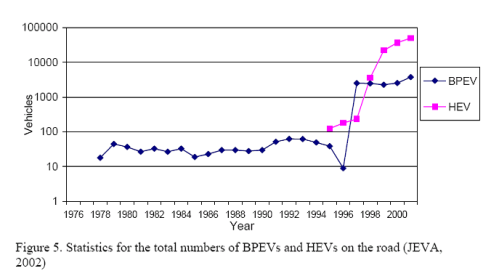

The R&D programmes first introduced by the MITI focused upon battery powered electric vehicles (BPEVs), which MITI and industry stakeholders adjudged to be the best technology option. However, the uptake was disappointing and only 655 BPEVs were introduced between 1977 and 1996, mostly in supported, niche markets (JEVA, 1996). The introduction of the Californian ZEV mandate in 1990 affected major Japanese manufacturers encouraging Toyota, Nissan and Honda to invest heavily in BPEV technology (Mauro, 2000; Patchell, 1999). Government purchasing programmes were implemented to encourage the uptake of the BPEVs, but these programmes fell far short of government targets, and infrastructure to support the operation of BPEVs was also slow to materialize. By 2000, the weak market response and stalling of the ZEV mandate in California led to a bleak domestic outlook for BPEVs.

LEV growth was catalysed by Toyota’s launch of the Prius hybrid electric vehicle in 1997, which saw technology developed for BPEVs put to use in a petrol-based HEV configuration. By 2001, over 50,000 HEVs were in circulation in Japan, and several new models of HEVs were being introduced onto the market. The MITI continued to provide financial support to HEVs by subsidizing half of the extra cost of an HEV compared to a comparable conventional vehicle (Daito, 2002). Toyota’s production and sales volumes gradually increased as the Prius captured greater market share. Cumulative sales of the Prius surpassed 1 million vehicles in 2008 and now most major car companies have a HEV in production or are in the process of developing such a vehicle.

Summary

- Japanese investment in LEVs was part of a long term plan implemented over several decades. It was a conscious decision taken by the government and Japanese vehicle manufacturers to invest in an area of strategic national importance and where Japanese industry already enjoyed a comparative advantage.

- In the latter stages, public support for, and private investment in, the new technology was motivated by a desire to position Japanese vehicle manufacturers ahead of their European and American rivals in a sector of the market that was considered to be strategically and economically important.

- The government took the lead in developing long term market expansion plans that coordinated the efforts of all public and private sector stakeholders around a shared vision that included specific targets.

- These targets proved to be unrealistic and none of the targets were ever met. However, the planning process was sufficiently flexible to allow the plans and the targets to adapt to changing circumstance and to reflect the technology and market learning and feedback.

- Much of the early R&D was focused upon BPEV technologies, which government and industry adjudged to be the most promising technology option. This judgment proved incorrect, reflecting the difficulties of picking “winning” technologies. Nevertheless, the advances made in BPEV technology fed directly into the more successful HEV technologies that made use of the electric drive train and battery technologies that came out of the BPEV research.

- Long term public support was based upon a cooperative model with industry. The R&D programs covered three distinct phases covering early stage R&D, demonstration and commercialization. The percentage of funding provided by the private sector was expected to increase as the technologies progressed through these three phases.

- Government subsidies, procurement programmes and the development of niche markets, all had a role to play in encouraging the early uptake of the new technology. However, it was not until HEVs became available that uptake increased in line with expectations, reflecting the ability of HEV technology to fit within the constraints of the existing transport infrastructure.

Filed under: Technology & Innovation | Leave a Comment

Tags: Case Studies, Electric, Innovation, Transport

No Responses Yet to “Government policy & the development of hybrid and electric vehicles in Japan”