The Waxman-Markey Bill at a Glance

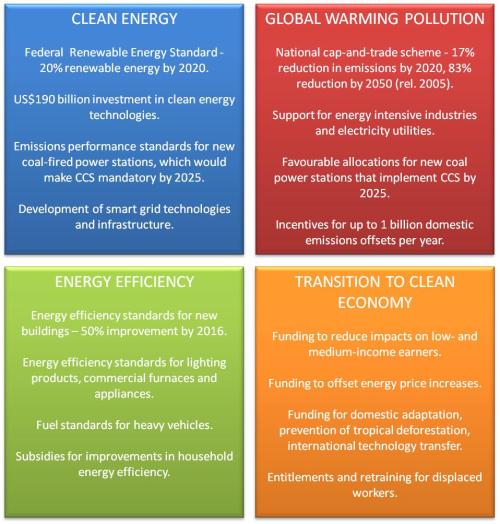

The American Clean Energy and Security Act, ACES, H.R. 2454, previously known as the Waxman-Markey climate and energy bill, was recently passed by the US House of Representatives on 26 June 2009. The key elements of the bill are presented below.

Sponsors

The Bill is authored by the House Energy & Commerce Committee and is sponsored by the Committee’s Chairman, Congressmen, Henry Waxman (D-California) and by the Chairman of the Environment & Energy Sub-committee, Ed Markey (D-Massachusetts).

Progress to Date

The Bill was drafted by the House Energy and Commerce Committee. It was released in a draft form in March 2009 and was subsequently amended. It passed the House Energy and Commerce Committee on 21 May 2009. The bill was subsequently sent before eight other congressional committees that have responsibilities relating to the content of the bill. The most important of these committees were the Natural Resources Committee, the Ways and Means Committee and the Committee on Agriculture. These Committees reviewed and endorsed the bill. On 26 June, the Bill was sent to the US House of Representatives, where it was passed by a vote of 219 to 212.

Next Steps

After the summer recess, the bill will be sent to the Senate, which has drafted a comparable bill on energy and climate change. The Senate bill, called the American Clean Energy Leadership Act (ACELA), is a bipartisan bill, authored by the Senate Committee on Energy & Natural Resources under the chairmanship of Senator Jeff Bingaman (D-New Mexico). This bill passed the Senate Energy & Natural Resources Committee on 17 June 2009. In addition, the Senate’s Environment and Public Works Committee, chaired by Senator Barbara Boxer (D-California) has been charged with developing provisions for a cap-and-trade scheme that will be incorporated into the ACELA. The Senate Majority Leader, Harry Reid (D-Nevada) has requested that these provisions, as well as all Committee mark-ups of the ACELA, be completed by 28 September. In all likelihood, for the Waxman-Markey Bill to pass the Senate, it will need to be ‘reconciled’ with the Senate’s ACELA, which will mean further changes and compromises. If this can be achieved, the joint legislation will be sent to both chambers for a final vote, before being sent to the President for signing into law.

Overview of the Bill

The bill comprises five titles.

Title I – Clean Energy: would set standards for conventional and renewable energy technologies and provide funds to support the development of clean energy projects and technologies.

Title II – Energy Efficiency: would mandate new energy efficiency standards for appliances, buildings, transport and industry and provide funds to support energy efficiency projects and technologies.

Title III – Reducing Global Warming Pollution: would create a national cap-and-trade scheme that would reduce GHG emissions from major sources by 17 percent by 2020 and 83 percent by 2050 relative to 2005 levels.

Title IV – Transitioning to a Clean Energy Economy: would provide financial assistance to those industries and persons affected by the Bill’s provisions and protect consumers from increases in energy prices.

Title V – Offsets from Domestic Forestry & Agriculture: would provide opportunities for domestic emissions from the forestry and agricultural sectors.

The Key Elements of the Bill

Clean Energy

Renewable electricity standard

The bill would create a nationwide renewable electricity standard (RES). States would be required to produce 6 percent of total electricity from renewable sources by 2012 and 20 percent by 2020. Up to 5% of the RES may be met with energy efficiency measures in place of renewables, rising to 8 percent under certain circumstances.

Eligible renewable sources are defined as wind, solar, geothermal, renewable biomass, biogas derived exclusively from renewable biomass, biofuels derived exclusively from renewable biomass, qualified hydropower commissioned after 1992, and marine and hydrokinetic sources.

Performance Standards for New Coal-Fired Power Plants & Carbon Capture and Sequestration

The bill would require coal-fired electricity generators to meet strict emission performance standards. These standards would effectively make the implementation of CCS technology mandatory at new coal-fired power stations. New coal-fired power stations that implement CCS technologies would be eligible to receive federal financial assistance in the form of freely allocated emission allowances, under certain conditions.

| Coal-fired plant permitted between 2009 and 2015 | Must achieve a 50 percent reduction in emissions by 2025. | Would be eligible for federal financial assistance if CCS is implemented within 5 years of commencement of operations. |

| Coal-fired plant permitted between 2015 and 2020 | Must achieve a 50 percent reduction in emissions by 2025. | Would be eligible for federal financial assistance if CCS is implemented upon commencement of operations. |

| Coal-fired plant permitted after 2020 | Must achieve a 65 percent reduction in emissions upon commencement of operations. |

The 2025 deadline may be brought forward in the event that more than 4GW of CCS is installed before this date, or it may be extended by up to 18 months on a case by case basis, at the discretion of the EPA.

Funds of US$1 billion per year would be made available for CCS demonstration and deployment – the proceeds to come from a levy or ‘wire charge’ on electricity produced from fossil fuels.

Investments in Clean Energy Technologies

The bill would direct an estimated US$190 billion through 2025 towards a range of clean energy technologies, including:

- $90 billion to renewable-energy and energy-efficiency programmes;

- $60 billion to carbon capture and sequestration technologies;

- $20 billion to electric and other advanced vehicles technologies; and

- $20 billion for basic research and development.

The bill would also create the Clean Energy Deployment Administration within the federal government to support private investments in clean energy technologies, including nuclear power.

Modernizing the Electricity Grid.

The bill also includes provisions to develop smart grid technologies and to improve the national transmission grid in order to accommodate the growth in renewable electricity sources.

Energy Efficiency

Energy Efficiency Standards for New Buildings

The bill would require State governments to update building codes, which would require new buildings to be 30 percent more energy efficiency by 2012 and 50 percent more efficient by 2016.

Energy Efficiency Standards for Lighting & Appliances

The bill would mandate new efficiency standards for lighting products, commercial furnaces, and other appliances.

Fuel Standards for Heavy Vehicles

The bill would require the EPA to introduce fuel efficiency standards for heave and off-road vehicles.

National Cap-and-Trade Scheme

The bill would create a national cap-and-trade scheme covering 85 percent of US emissions with the long-term goal of delivering an 80 percent reduction in GHG emissions relative to 2005 levels by 2050.

Coverage

Emissions caps would be placed electricity generators, oil refiners, natural gas suppliers, and energy intensive industries such as iron and steel, cement and paper. The caps would cover approximately 85 percent of US GHG emissions by 2016.

Emissions Caps

The proposed scheme would commence in 2012. Emissions caps would be defined relative to 2005 levels and would rise from a 3% reduction by 2012, to 17 percent by 2020, 42 percent by 2030 and 83 percent by 2050.

Allocation of Emission Allowances

At the start of the scheme, approximately 15 percent of emission allowances would be auctioned. This percentage would increase gradually over time. The revenue raised form auctions would be recycled to consumers through a combination of refundable tax credits and electronic benefit payments to minimize the impact of the scheme on low- and middle-income earners. The bill sets a minimum auction price of US$10 in 2012, rising at 5 percent plus inflation in subsequent years.

At the start of the scheme, approximately 85 percent of emission allowances would be allocated gratis. Of those allowances, about one-fifth would be allocated to liable parties, in order to reduce the impact of the scheme on key sectors.

| Party | Free Allocation |

| Liable Parties | |

| Energy intensive industries, such as iron and steel, cement and paper. | 15 percent from 2014, gradually reduced in line with emission reductions, then phased-out after 2025. |

| Coal-fired electricity generators and other electricity generators under long term supply contracts. | 5 percent through 2025, then phased-out by 2030. |

| Oil refineries. | 2 percent through 2025. |

| Electric utilities – CCS technology development | 2 percent through 2017, rising to 5 percent thereafter – to be used to cover the costs of CCS. |

About two-thirds would be allocated to parties not covered by the scheme, in order to support the development of clean technologies and to reduce the impact of the scheme on low- and middle-income households.

| Party | Free Allocation | |

| Affected Parties | ||

| Electricity distributors. | 32 percent through 2025, then phased-out by 2030 | The proceeds to be used to offset increases in retail electricity prices arising from the scheme. |

| State governments. | 10 percent through 2015, then declining gradually to 5 percent by 2022.

1.6 percent through 2025. |

The proceeds to be used to fund renewable energy, energy efficiency, clean transport and transmission infrastructure projects.

The proceeds to be used to offset increases in home heating oil. |

| Natural gas distributors. | 9 percent through 2025, then phased-out by 2030. | The proceeds to be used to offset increases in retail energy prices arising from the scheme and to fund energy-efficiency projects. |

| Vehicle manufacturers. | 3 percent through 2017, then 1 percent through 2025. | The proceeds to be used to fund the development of clean vehicle technologies. |

And about ten percent of allowances would be allocated to help support the transition to a clean economy, adaptation and international technology transfer.

| Party | Free Allocation | |

| Domestic Adaptation | 2 percent through 2012, then 4 percent through 2026, then 8 percent thereafter. | The proceeds to be used to fund domestic adaptation. |

| Preventing Tropical Deforestation | 5 percent through 2025, then 3 percent through to 2030, then 2 percent thereafter. | The proceeds to be used to prevent tropical deforestation and build capacity in this area. |

| International Adaptation | 2 percent through 2021, then 4 percent through to 2026, then 8 percent thereafter. | The proceeds to be used for international adaptation and clean technology transfer. |

| Worker Training | 0.5% through 2021, then 1 percent thereafter. | The proceeds to be used for worker assistance and job training. |

Preliminary modelling by the EPA estimate that allowances will be worth between US$11 to US$15 in 2012 and US$22 to US$28 in 2025. The total value of all allowances would be US$60 billion in 2012 and US$113 billion in 2025.

Cost-Containment Measures

The bill contains a number of provisions that are designed to provide flexibility and contain the costs of the scheme. These include:

- unlimited banking of allowances;

- a two-year compliance period (which permits borrowing one year in advance);

- the right to borrow up to 15% of allowances from years 2 to 5 beyond the current year, but subject to payment of 8% interest;

- a strategic reserve of allowances that are available for auction if allowance prices exceed 160% of their three-year average.

- a minimum price of US$28 in 2012 for allowances auctioned under the strategic reserve provisions, thereafter rising at 5% plus the rate of inflation up to 2014. Thereafter, the minimum price will be 160% of the three-year average price of traded allowances.

Emission Offsets

The bill would permit liable parties to use up to 2 billion emission offsets to meet their obligations under the scheme in any given year.

Half of these offsets must be obtained from domestic sources and half from international sources. In the event that insufficient domestic emission offsets are available, the portion of international offsets may be increased from 50 percent to 75 percent of the total.

The EPA will determine the eligibility of offset projects on the advice of the Offsets Integrity Advisory Panel, which would be established under the Bill.

The US Department of Agriculture (USDA) will oversee the offsets from domestic forestry and agricultural sources.

Penalties for non-compliance

The penalty for failure to comply with the emission cap will be a fine of two times the ‘fair market value’ of the missing allowances.

Interaction with pre-existing Trading Schemes

The bill would require that pre-existing state and regional emissions trading schemes be suspended over the period 2012 to 2017. Allowances issued under these schemes before 31 December 2011, would be redeemed or exchanged for federal allowances.

Regulation of Trading

The bill sets out a framework for the regulation of trading in allowances and their derivatives. The Federal Energy Regulatory Commissions will be charged with the regulation of the cash market in allowances and offsets; while the Commodity Futures Trading Commission will have responsibility for the regulation and oversight of the derivatives market. Notably, the bill would prohibit over-the-counter trading of derivatives.

Transition to a Clean Economy

Cost-Containment Measures

The bill also includes a number of additional measures intended to reduce the impacts of the bill on those persons likely to be the worst affected by the transition to a clean economy. These measures include:

- increased funding for the Energy Worker Training Program;

- entitlements for workers displaced as a result of the Bill; and

- college and university grants to prepare students for careers in the renewable energy and energy efficiency fields.

Trade Measures

The final version of the bill also introduces new trade provisions. These provisions would requrie the President, from 2018 and in the absence of an ‘equitable’ international agreement, to introduce a system of international reserve allowances for imported goods. These provisions would effectively extend the proposed cap-and-trade scheme to designated imports. Under such a scheme, importers would have to acquire allowances before products covered by the scheme could be sold in the US. The price for these international reserve allowances would be set daily so that it was ‘equivalent’ to the auction clearing price for domestic emission allowances. In this sense, it is similar to an import permit program. Provided that these provisions are applied equally to domestic and imported ‘like products’ they would be entirely consistent with WTO rules. Nevertheless, the devil will be in the detail. A great deal will rest upon how embodied CO2 can be included in the definition of ‘like products’ – this will raise a number of extremely complex issues relating to the calculation of embodied CO2 in a manner that is consistent between like products – each of which would conceivably be subject to challenge under WTO rules. The President and the Congress may waive these provisions.

Costs of the Scheme

The Congressional Budget Office (CBO) estimates that the bill would increase government revenues by US$873 billion over the 2010-2019 period and would increase direct government spending by US$864 billion over that 10-year period – creating a net revenue in the order of US$9 billion. The CBO estimates that the bill will increase energy costs for an average American household by US$175 a year.

Useful Sources

US House of Representatives, Committee on Energy & Commerce

Environmental Protection Agency, Analysis of The American Clean Energy and Security Act

Congressional Budget Office, Cost Estimate of The American Clean Energy and Security Act

Filed under: Policy | 6 Comments

Tags: Emissions Trading, Policy, US, Waxman-Markey

Would like to receive update on Waxman Markey Bill on regular basis